The fact that the American healthcare system is the world’s most expensive yet one of the world’s least cost-effective is not a subject of much debate. It’s a fact that has been repeated over-and-over again in every major news publication and discussed ad nauseum in every major legislative and regulatory body throughout our country over the last decade. What is a subject of debate, however, is how best to fix it, and who should bear the primary responsibility for driving the kind of change we all would like to see in terms of greater transparency, demonstrably more value per dollar of healthcare spend, and a patient experience that inspires confidence through its clarity and ease-of-use.

As we witness the rise and fall of Obamacare and the national health insurance mandate, it’s clear that government cannot be expected to fix the problem. Similarly, due to the perverse incentives that govern how incumbent participants in our healthcare system prioritize their efforts, it should also be clear that the will to drive meaningful change will not be found there either.

American employers are in the healthcare business and they are in the best position to drive positive change

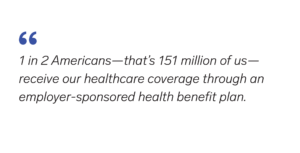

Employers play an outsized role in the purchase and provision of healthcare in the United States. To put the importance of employers in the U.S. healthcare economy in perspective: nearly 1 in 2 Americans — that’s 151 million of us — receive our healthcare coverage through an employer-sponsored health benefit plan. Of those, 3 out of 4, or about 108 million of us, receive health coverage through a self-insured employer plan, meaning our employer bears the financial risk of paying for the healthcare of its employees and their dependents.

That dwarfs the 68 million Americans covered by Medicaid or the 58 million covered by Medicare. As a result, American employers spend nearly $1.2 trillion annually on healthcare for their employees and their families, equaling the $1.2 trillion spent annually by the federal government on Medicare and Medicaid combined.

Measured in country terms, annual U.S. employer healthcare spend is larger than all but the world’s top 13 countries’ annual Gross Domestic Product (GDP). That means American employers spend more on healthcare each year than the entire economies of Indonesia (a country of 260 million) or Mexico (a country of 125 million).

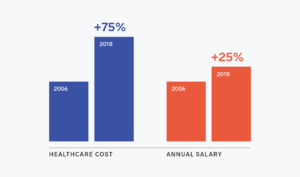

Moreover, the outsized inflation in healthcare costs over the past two decades has eaten into workers’ real wages, as well as the cash flow available to employers to re-invest in their businesses. From 2006 to 2018, the total cost of healthcare per employee (reflecting both employer and employee costs) has risen 75% from $8,079 to $14,156 a year, while the median annual salary of a full-time American worker grew by only 25%, from $35,464 to $44,564. The result? Not only are employers spending more on healthcare today than ever before, employees are seeing more and more of their compensation go toward healthcare costs each year. For a typical U.S. employer, healthcare often represents the second largest operating expense after employee wages. And for the vast majority of employers, it represents the fastest-growing operating expense — one that they feel they have little or no control in managing.

As a result, the percentage of employers who have chosen to self-insure their employee healthcare plans has accelerated over the past two decades, as employers seek to gain more control over their healthcare spending and more mechanisms become available to incentivize and encourage workers to take better care of their health. In 1999, only 60% of U.S. employers with 200 employees or more self-insured their health benefits. By 2017, that number had risen to 79%. And it shows no sign of slowing down — today, 91% of covered workers at firms with 5,000 or more employees are on self-funded plans.

Stated slightly differently, the biggest health insurance company in our country isn’t a health insurance company at all. It’s the tens of thousands of self-insured employers — along with our self-insured government — that underwrite the vast majority of Americans’ healthcare costs. So if you’re running a company in America, regardless of what industry you’re in, you’re in the healthcare business. And that means you need the right tools to be able to manage that critical line item in your corporate budget and drive a measurable return on your investment (ROI) in the experience and health outcomes of your employees.

Obsolete technologies, siloed data models, and outmoded user experience technologies have held back progress

In spite of employers’ clear willingness and increasing attempts to take greater control of their healthcare spending through self-insurance and other mechanisms—exemplified by the rapid rise of corporate wellness programs, onsite clinics, telemedicine services, and novel clinical models, over the past decade—employers are still heavily reliant upon a long list of vendors to manage their healthcare spend. This includes unique contracts with major health insurance carriers to administer their employee health benefit plans, data warehousing vendors, health benefit consultants, medical stop-loss vendors, and more to help manage the myriad manual tasks required to run a functioning self-insured health benefit plan.

Contrasted with other areas of concentrated employer spending, like payroll, or sales and marketing, the distinct absence of a modern, technology-driven approach to managing this effort stands out. To understand why employers depend on these complex arrangements, we need look no further than the antiquated, error-prone administration systems that power the “back office” of today’s healthcare industry.

The traditional health insurance infrastructure we have come to depend on was built in an era in which large-scale population analysis and workforce health optimization weren’t the guiding principles, or technically as feasible as they are today. These systems are transactional in their design and were built to pay claims and to issue an explanation of benefit, or EOB. As such, it is frequently the case that important metadata such as demographic information, previous claim history, and other contextually useful data is often stripped out of such systems to facilitate the processing of claims and the issuance of EOBs.

Unfortunately, the removal of that metadata hampers employers’ ability to perform insightful, large-scale, machine-based analysis on the underlying trends driving healthcare spending of a given population once the claims have been processed and paid. Compounding this effect is the fact that medical claims data are processed and housed in different systems (and more often than not, in different companies’ systems) than pharmacy claims data, dental claims data, vision claims data, digital healthcare program data, etc. All of which makes for an incredibly fragmented and daunting data acquisition and analysis problem for your typical American employer to get their arms around.

As a result of these shortcomings, investment in Healthcare Information Technology (HCIT) companies has ballooned over the past five years. According to Pitchbook, venture capital investment in HCIT companies grew from just over $1 billion annually in 2012 to nearly $5 billion annually in 2017. Much of that investment has been focused on companies that are delivering novel ways to deliver care to people — digital versions of the doctor’s visit, second-opinion services, etc. But, interestingly, not as much investment has been made to-date on trying to bring the oceans of disparate and separated data together in one place. The reason behind that should not be surprising: venture investors want to make a return while minimizing their investment risk, and the idea of trying to build a platform to bring all of this data together in one place sounds decidedly riskier than a digital healthcare app designed to make people take more steps every day or manage a specific chronic illness.

The rise of the Employer-Driven Healthcare Economy

In spite of the incredible complexity described above, employers have continued to demand more visibility and control across all of their healthcare programs and spending. At the root of this drive lies deep dissatisfaction with a rate of healthcare inflation that far outpaces the inflation rates of other core business inputs, such as wages or raw materials, compared with alarming trends like declining life expectancy and the proliferation of large-scale chronic disease among employee populations. We call this the Employer-Driven Healthcare Economy.

In contrast to failed government-led initiatives to encourage the healthcare industry to act more boldly than it historically has been inclined to do, American employers are impatient with the system’s poor performance, and have become drivers of innovation. Take Intel as an example. Intel — a company famous for driving innovations in employee healthcare — has leveraged its purchasing power to redesign the local healthcare system in Portland. Using its deep expertise in supply chain management, Intel has markedly improved both the quality of care for its Portland-based employees and their families while significantly reducing waste and lowering overall costs. They’ve done this by using their significant purchasing power in that market to make all participants in the Portland healthcare market work much more cooperatively together.

While not all companies have made such bold moves, many are taking advantage of new approaches to gain more control over their investments. Today, 96% of large employers offer telemedicine services (up from 7% in 2012), 54% offer onsite or near site health centers (up from 47% in 2016), and 21% have incorporated ACOs into their strategies (a figure which is projected to double by 2020). These new approaches let employers break the traditional care model, to not only improve the patient experience but better control costs.

And this is just the beginning. While employers have demonstrated an appetite for change — and, as a result, created a massive market opportunity for a new generation of healthcare companies — employers face more choice and opportunity than ever before. What’s been missing to-date is an employer-centered technology infrastructure that ties all of these novel healthcare products, experiences, and data together.

Introducing the Workforce Health Management System (WHMS)

One major gap in the Employer-Driven Healthcare Economy is the equivalent of the A/B test that defines how most innovative companies test new products and features. Imagine a world where you, as an employer, could quickly install new health programs (be they in-place or delivered digitally), make them available seamlessly to employees and their families without the need for a chain of separate logins and passwords, and then quickly measure the effectiveness of those programs and reallocate your healthcare spending based on the results.

Similarly, imagine a world where you, as someone covered by your employer’s health benefit plan, were guided — through a combination of machine learning-based data analysis algorithms and a consumer-grade user experience (think Amazon or Apple here) — to the most appropriate care for you. Imagine using a health plan that understood that your influenza was potentially more serious than you may have thought and routed you to a virtual visit where your doctor prescribed a powerful antiviral treatment — all without having to leave the comfort of your home.

Or imagine using a health plan that knew that your employer covered autism care for your family and had already contracted with highly-qualified autism therapy specialists. Imagine calling or emailing your plan only to have a recommendation already waiting for you, along with software and people on the other end who anticipated your needs and automatically scheduled a visit for you or a loved one at a time and place most convenient for you given what they knew about your office location and the hours that you worked.

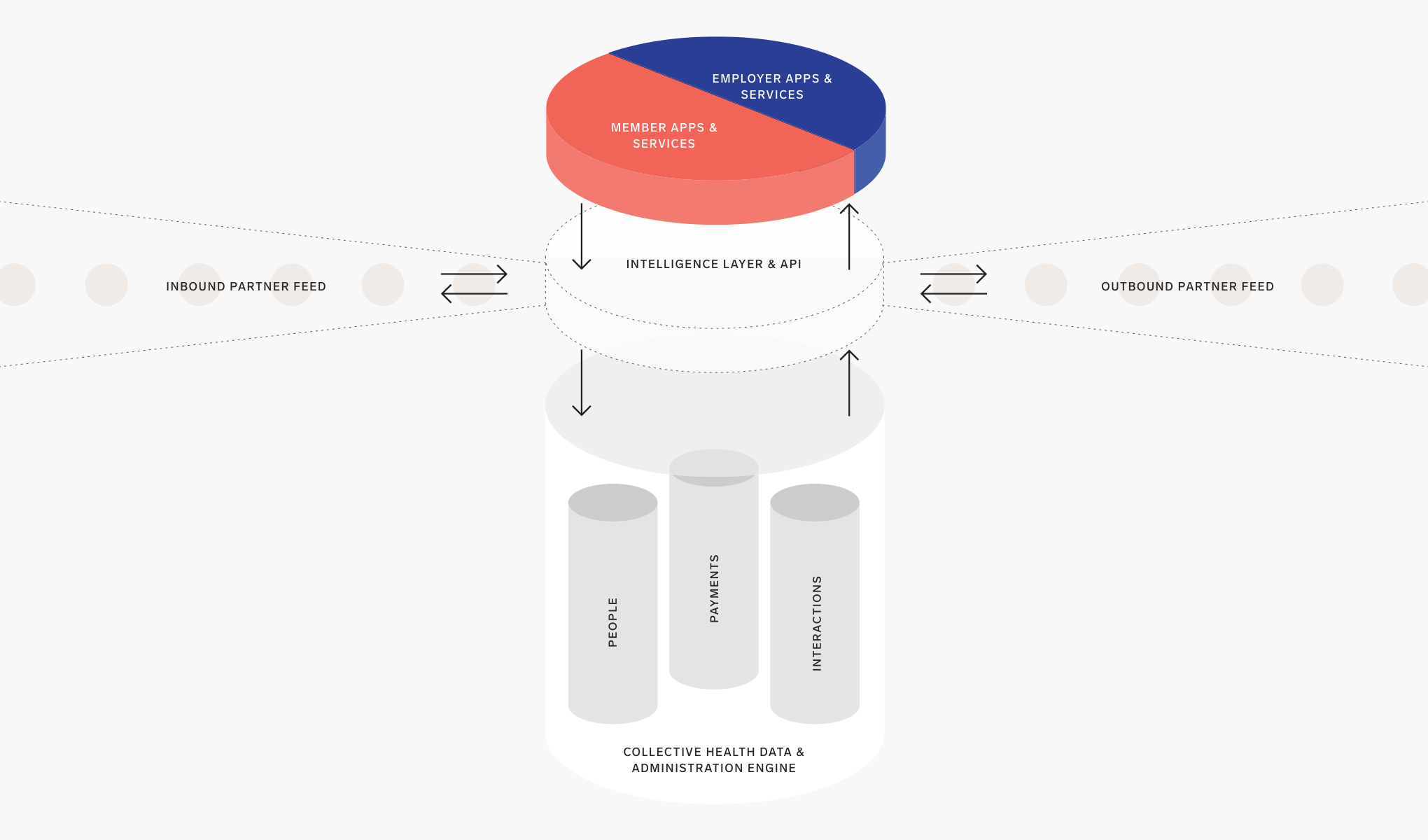

This may seem like science fiction in the world of healthcare that we live in. But this is precisely the future we’ve been building at Collective Health for the last four-and-a-half years — a new category of enterprise software and service we call a Workforce Health Management System, or WHMS.

A WHMS unifies all of an employer’s health and wellness plans and programs into one extremely powerful and intuitive user experience for employees and their families. At the same time, a WHMS provides employer HR and Finance teams with real-time data on the use and effectiveness of those plans and programs. The result is that both employees and employers benefit from a single, intuitive system to access and navigate all information and options related to their health benefit plans, thereby maximizing the value of an employer’s investment in its employees’ health.

Core capabilities of a Workforce Health Management System

To deliver on the promise of enabling employers to drive better health outcomes for its employees while better managing spending, a Workforce Health Management System must possess four core capabilities:

Cloud-Based, Connected Health Plan Administration

A WHMS must be built on software designed for the modern enterprise. This means cloud-based SaaS software capable of integrating with other critical SaaS-based enterprise Finance and HR software systems, like payroll systems and Human Resource Information Systems (HRIS). Traditional health insurance carrier systems were designed and developed in an era where cloud-based software didn’t exist and when the need to integrate other enterprise cloud systems wasn’t a requirement.

Consumer-Grade User Experience

An effective WHMS must possess a truly consumer-grade user experience to engage people covered by an employer health benefit plan with the effectiveness required to drive behavior change. That means offering world-class native mobile, web, and telephonic capabilities that engender clear understanding and confidence when navigating healthcare options. And the user experience must be underpinned by cutting edge data systems and modern, machine-based algorithms and software that can analyze trillions of user engagement interactions at any given time and make subtle, yet highly effective, adjustments in what to show a user in order to drive more confident and clear user decisions when it comes to choosing the right care at the right time.

Open Ecosystem of Partners

We live in a highly interconnected world, and healthcare should be no different. With the proliferation of thousands of new digital health applications and in-place health point solutions, a modern WHMS needs to enable an open ecosystem of partners to integrate their service experiences and data programmatically in order to streamline access to those apps and solutions without the need for multiple logins, passwords, and user experience “front doors” competing for a health plan enrollee’s attention. Similarly, programmatic data integration enables the WHMS to fulfill one of its core functions of providing real-time insights to employers on the effectiveness of their investments in digital health applications and point solutions.

Real-Time Performance Intelligence

Gone are the days of year-old claims reports that once defined how employers expected to measure the performance and effectiveness of their employee health benefit plans. Just like the expectations today’s employers have for how they manage other critical business functions — from company finances to sales pipelines — today’s employers expect real-time performance intelligence and insights from their health benefit plan administrators across everything they invest in when it comes to employee health and wellness. A modern WHMS must ingest all the utilization, spend, and user experience data from all components of an employer’s health benefits offerings and return accurate, timely insights back to employers so they can reallocate their healthcare budgets as quickly and effectively as possible.

Evaluating Workforce Health Management Systems

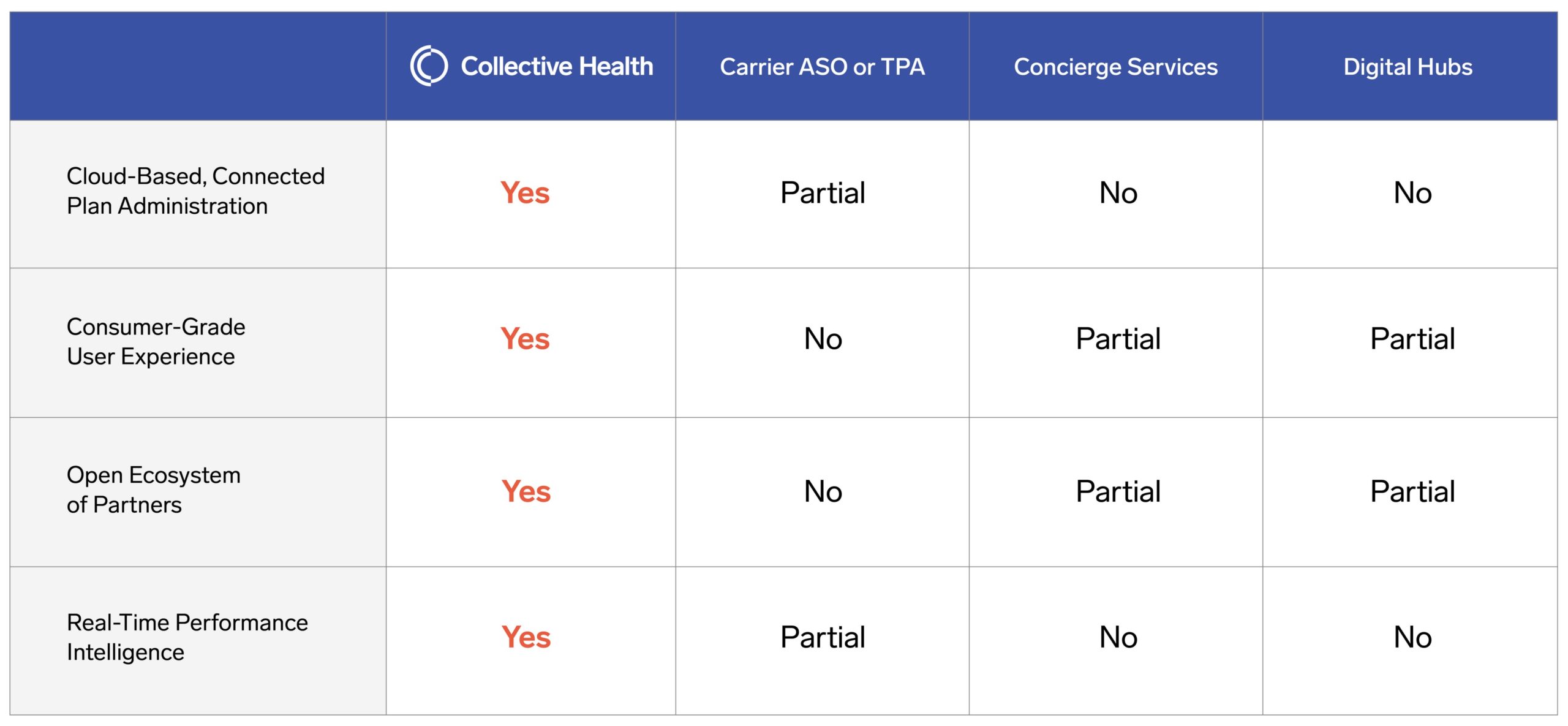

Employers will evaluate Workforce Health Management Systems across the four criteria above. Importantly, employers will need to consider how to fill any gaps in any of the four criteria should a solution not provide all of the capabilities essential to being classified as a true WHMS.

The table below illustrates how a WHMS, like Collective Health, compares to traditional health insurance carrier administrative services only (ASO) or third-party administration (TPA) offerings, along with concierge and navigation service offerings.

Ultimately, the results will speak for themselves. To be considered a WHMS, a solution must deliver measurable results in both cost management and user experience, as well as administrative efficiency. As we recently published, the holy grail of providing a world-class user experience to health plan members is entirely in line with — in fact, we would argue absolutely essential to — delivering outstanding financial performance of a health plan.

At Collective Health, we are incredibly proud of the fact that we’ve enabled an industry-leading 0.1% annual medical trend across our book of business of self-insured customers, delivered an unparalleled experience to our members with a Net Promoter Score of 76, and helped HR and Finance teams reduce health plan administrative tasks by up to 60%. Any WHMS or competing solution will, ultimately, need to be compared against these performance benchmarks.

Empowering employers with modern data and technology is the way forward

In many ways, Henry J. Kaiser and Dr. Sidney Garfield laid the foundation for the Employer-Driven Healthcare Economy in the early 20th century by developing Kaiser owned-and-operated hospitals and clinics for Kaiser’s shipyard workers. And although the nature of work in the U.S. has changed markedly over the last 80 years, one thing still holds true: employers have always been at the forefront of driving innovation in U.S. healthcare.

With the advancement of a knowledge-based economy and recent innovations in software development, user experience design, and large-scale data analytics, U.S. employers can take much more effective control of their massive annual investment in employee healthcare. Similar to recent innovations in software-driven systems like NetSuite, Salesforce, and Workday for Financial Planning and Analysis (FP&A), Customer Relationship Management (CRM), and Human Resources (HR) — a technology-driven Workforce Health Management System can pave the way for employers to gain clarity, insight, and control into their healthcare investments and the healthcare experience of their employees and dependents.

I started Collective Health four-and-a-half years ago after a rough personal experience with the healthcare system. Many of our nation’s most admired and innovative companies are increasingly calling for precisely the kind of change we’ve been building toward at Collective Health — American healthcare that is dramatically more transparent, user-friendly, and cost-effective than it is today — and we look forward to helping them realize that vision. We hope more people will join this important movement to empower employers to take better control over their employees’ healthcare experience and investment, and we look forward to the positive change that they will undoubtedly drive in our troubled healthcare system in the years to come.