Open enrollment season is nearly here, and most of your employees would rather toss their car keys down a storm drain than sort through their benefits information. And we get it–making sense of complicated healthcare jargon and committing to decisions about healthcare, especially months in advance, can be daunting.

But you’re not afraid of open enrollment season. No, you’ve been preparing for this moment the whole year. You’re more than ready to take the wheel and guide your employees smoothly to the destination, where they know how to use their benefits and feel confident in the healthcare choices they’ve made for themselves and their families.

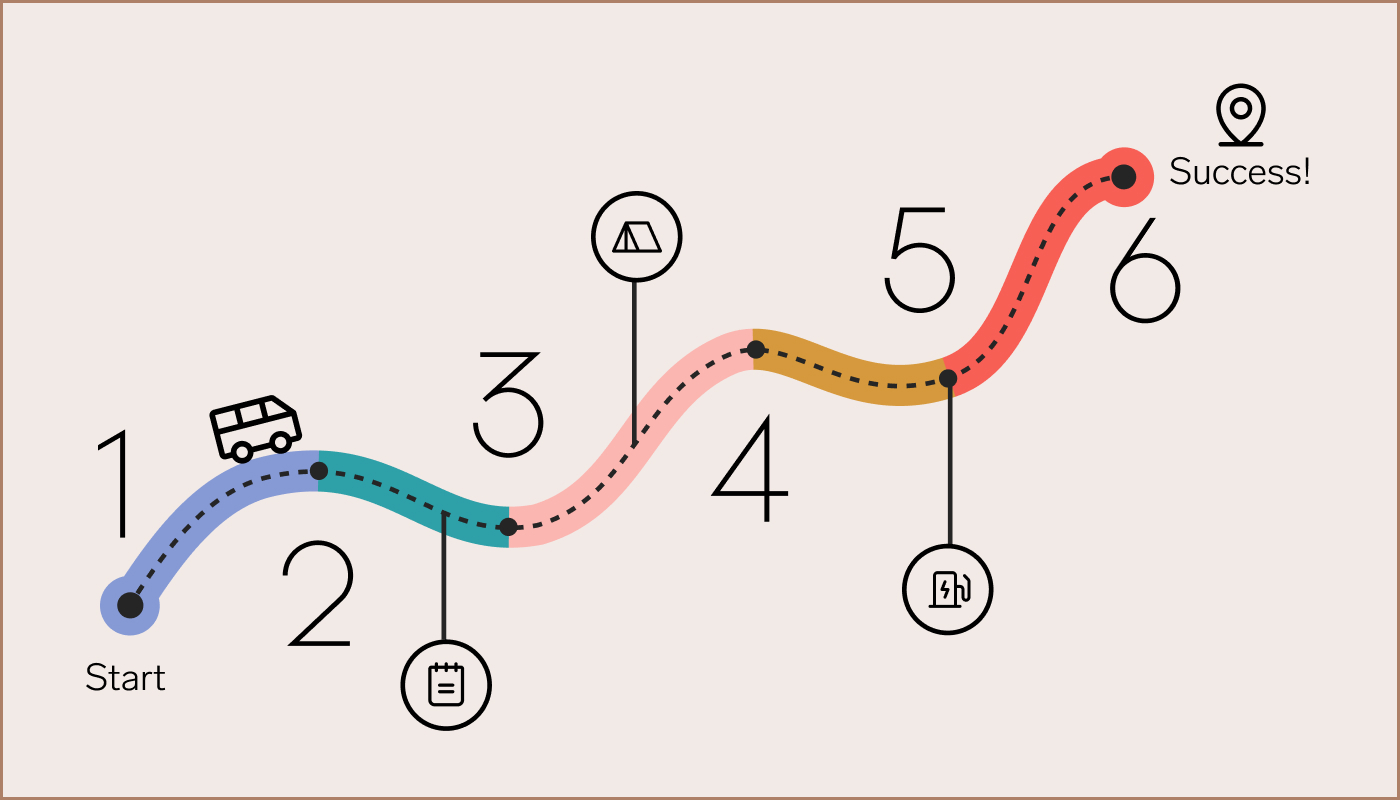

At Collective Health, we like to think of open enrollment as the ultimate cross-country road trip, requiring careful navigation and strategic pit stops. We’ve put together some key steps we think are crucial to getting the most out of open enrollment. Instead of white-knuckling the entirety of this journey, we want this experience to make you feel like throwing open the windows and feeling the wind in your hair.

So let’s get started and begin rolling down the open road.

1. Set your journey on the right path.

A successful road trip–one that gets you to your destination on time and in good spirits–starts well before you leave the driveway. Think of this step in your open enrollment planning as essential car maintenance. Knowing exactly how your health benefits machine is functioning will allow you to set a strategy that works best for your company and give you the confidence you need to get started.

Review last year’s open enrollment journey. Last year’s successes, as well as any missteps, hold the key to navigating this year’s open enrollment as smoothly as possible. As you go over last year’s experience, ask yourself and your benefits team these questions:

- Which tasks were the most time-consuming?

- Were there any big surprises or unexpected problems?

- What do you wish you had done differently last year?

- What kind of feedback did you receive from your leadership teams, managers, and employees?

Chat with your people. Gather intel from your management teams, as well as your employees, about how last year’s enrollment went, their hopes for this year, as well as personal attitudes towards their health benefits. Schedule quick meetings with your managers or send out short surveys. Ask them questions that help you understand what went well and what didn’t, so you know how to shape your strategy this year. Here are some sample questions we like:

- What are one or two things you would’ve done differently regarding your benefits choices, if you had the chance?

- Which materials did you use to make last year’s open enrollment decisions?

- What process do you and your family follow when picking benefits?

- What are your top concerns going into this year’s open enrollment?

Identify potential roadblocks. Before you start moving, be sure to look out for any pitfalls that could derail your plans. Recognizing these possible difficulties before they arise will help you set an adaptive and flexible strategy that gets you closer to your goals. Consider whether any of the following challenges apply:

- You’re rolling out big changes to your benefits this year.

- You have hard-to-reach employees, such as remote or rural workers, or those that speak languages other than English.

- Your employees have historically been reluctant to attend open enrollment meetings or read your emails.

2. Create clear goals.

Sometimes getting from point A to point B isn’t the only objective of a road trip. Just as a traveler may want to take in the sights or check monuments off their bucket list, your open enrollment goals will likely extend beyond simply hitting 100% employee enrollment. Think about how open enrollment fits into your overall benefits strategy, so that your team can all work towards the same end.

Align with leadership. Beyond simply ensuring your employees have healthcare, think about what your company’s leadership hopes to achieve with their overall benefits strategy. Put yourself in your boss’s shoes, or meet with them directly, to get an idea of what big-picture goals you should be aiming for. Maybe this year, for example, there are new financial considerations at play, or the leadership team is especially fired up about employee retention and satisfaction.

Mark your destination. Once you’ve met with leadership and your benefits team, set your goals in tangible terms. The goals you outline for your team should be clear with respect to implementation targets, as well as the high-level intentions that will guide your work throughout the year. Here are some sample open enrollment targets, whose structure you can follow to set goals in accordance with your company’s own priorities.

- Increase the number of employees who sign up before the deadline by 25%.

- Increase the number of employees who enroll in a specific program by 10%.

- Improve post-open enrollment satisfaction by 10% over last year.

- Reduce employee turnover by 5% over last year.

Define key metrics. A set of goals will help you know where you’re headed, but without setting metrics, it’s like using a map with no legend. (Imagine taking a wrong turn and not realizing until you hit a dead end!) The right performance and progress metrics will help you understand how open enrollment is going, plus give you the information you need to redirect your team if you venture off course.

We suggest starting with a few basic metrics, which your health plan will be able to provide:

- Percent of employees enrolled

- Number of employees enrolling per day, or velocity of enrollment

- Percent of employees enrolling in or opting out of specific offerings

On a more granular level, use your open enrollment site to track engagement with open enrollment messaging and materials. (Collective Health’s member portal, for example, tracks website visits.) Work with your benefits team to identify some key metrics:

- Email open rate and click-through rate

- Number of open enrollment site visits

- Number of open enrollment video views

- Number of flyers posted

- Number of attendees for in-person or virtual office hours, webinars, Q&As, and meetings

And in accordance with your higher-level benefits objectives, consider adding some of the following metrics to track year-round:

- Employee satisfaction via surveys

- Benefits and health plan satisfaction

- Employee turnover rate or turnover risk assessments

3. Map out your route.

Brace yourself for the inevitable ‘Are we there yet?’s and design a schedule that’s easy to follow. Set up some basic metrics that will help your team report on your progress.

Build your calendar. You may already have a calendar template from last year, and if not, your health plan partners or consultants will likely have resources that you can use as a jumping off point. From there, add as much detail as possible, marking each email, Slack message, virtual meeting, and in-person event so that your benefits team is in the loop on all of your communications to employees. Build in enough flexibility, however, that you can change course if you hit any major road closures.

Identify your checkpoints. Once open enrollment has officially started, you’ll want to know exactly where you are in the process, where you’re headed, and what’s coming next. Using your open enrollment calendar and the metrics you decided to measure in the previous step, mark some key spots to check in on your progress and evaluate whether you’re still on the right track. Here are some landmarks to consider checking out along your journey:

- Check in at the end of each week on your forward movement by calculating the percent of employees enrolled.

- At the end of each week, review your engagement stats. If one or several of your programs, such as an in-person event , is more effective with your employees than other methods, consider adding more of those to your lineup.

- Plan a check-in for a week before the deadline, when you can review which methods will help you close the gaps for the final stretch.

4. Energize your workforce.

Once the groundwork has been laid, it’s time to hit the road. On your marks, get set, go!

This stage of the open enrollment adventure is all about engaging employees, keeping them informed, and helping them make the best possible decisions for themselves and their families. Your job is to supply the energy so that your workforce (and especially your benefits teams!) has the juice to make it to the end of open enrollment season.

Get creative! Your employee population is a truly unique bunch of people—use more than one form of communication to capture attention across the entire group.

Detail-oriented, tech-savvy people may be able to absorb all they need to know by reading a single thorough email or a searchable intranet page. Others will likely benefit from a series of short bursts of information or regularly spaced reminders. Visual or auditory learners may learn better from short- and long-form videos that use eye-catching diagrams. Employees with families or complex needs may benefit from 1:1 office hours or benefits coaching to help decipher your benefits offerings. Work with your benefits teams to identify which forms of communication will make the most sense for your organization.

Talk like a human. We know that information about health plans can be both difficult to understand and–let’s face it–kind of a snoozefest. Even people who understand the finer details may tune out if they have to read page after page of overly wordy or jargon-y language. Use plain language to help your employees cut through the noise and identify the key pieces of information they need to know. Work with your health plan partner to figure out which terms cause the most confusion and create “translations” or definitions that are easier to understand.

Break up your requests into discrete steps. Some people like to knock out big tasks in one go, and some like to divide them into bite-sized chunks so they can finish them one at a time. Give your employees a list of each step you need them to take, such as reviewing health plan options, making a list of anticipated healthcare needs, deciding on spending accounts, and so on. Be sure that your registration system allows employees to save their progress and provide estimates of the amount of time each step will take to complete so that they can set aside the time accordingly.

5. Build momentum and beat procrastination.

You’re officially on your way! People are opening your emails, showing up to Q&As, and signing up for their health plans until–suddenly–the numbers drop off. Enrollment seems to be slowing down and it looks like you’ll never get to 100% at this rate.

Even the best laid plans can hit a rough patch. Meet with your benefits team to review where employees seem to be disengaging and identify areas to redirect your focus. Here are some methods we’ve found to help you get back up to speed and keep your employees on track.

Update your calendar. Review your engagement metrics to identify any forms of communication or outreach that seem to be resonating with your employees. Are people not showing up to in-person events but your virtual Q&A sessions are overloaded? Add another one to the schedule! Are people opening one email far above the others? Consider resending or trying the same content in a different medium, like Slack or text messaging.

Bring out all the stops. Show-stoppers may seem like a bit much, but they work (and boost morale!) Break up the mundanity of day-to-day office life and mix up your communication by planning some fun and exciting new offerings or events. Here are some of our favorite ideas:

- Offer an extra PTO, holiday, or even half-day to all employees who sign up before a certain deadline. (Try the Friday after Thanksgiving, if that works for your employee base.)

- Add a big surprise to your open enrollment events. The more novel the better–think an ice cream bar, puppies in the office, or lawn games.

- Cater lunch, happy hours, or snacks for in-person meetings, and invite family members and dependents to join so everyone can be involved.

- Offer small gifts or prizes to employees who attend Q&A sessions and ask questions! Throwing them into the audience for a question or sending a virtual gift card will grab the attention of the entire audience.

Gamify participation. Like the road trip games of your childhood, competition can make the trip feel shorter (and more fun!), plus boost motivation to keep going. Instead of playing Punch Buggy, however, try grouping your workforce by department, manager, floor, or even shift, and offer a prize to the first group to reach 100% enrollment. Create a leaderboard to really rev up competitive spirit. Prizes can range from company merch to a happy hour to a half-day off, or whatever makes the most sense to your teams.

Anonymize questions. Some employees who sign up late may not be procrastinating, but instead have questions that they don’t know how to ask (healthcare decisions are often deeply personal, after all). Create a message board or forum for people to ask specific questions, like “If you’ve used our fertility benefits, what wasn’t covered? Did you also use a secondary plan of some sort? What did you wish you had known before starting?” or “For diabetes, do you think the Blue Shield or the Kaiser plan is better?” without having to reveal PHI.

Reach out to stragglers. Get ahead of problems before it’s too late. If you have the data available, identify the employees who enrolled at the very end of open enrollment last year and tailor communications to these individuals specifically. Loop in their managers to personalize the messages to their specific questions or concerns.

6. Finish strong.

The ride is finally coming to an end and you can see the light at the end of the tunnel. Don’t rush to get things over with—use this time to assess how open enrollment went, tie up loose ends, and set yourself up for success next year.

Put the pedal to the metal. The final days of open enrollment are the perfect time to try out the more in-your-face tactics that you previously held off on. Send mobile notifications or calendar invites directly to employees, or put physical flyers in hands and on computers. Ask your broker or consultant for extra support helping your team round up the remaining unenrolled employees.

Go over reporting. Think of this as the first step in next year’s open enrollment process. (Look how on top of it you are!) Go over the metrics you set up to track your progress and see what went right and what fell a bit short. Were there any unexpected hiccups? Any big surprises? Dig deep so you can let your team know exactly how this year’s open enrollment played out and prepare for next year.

Celebrate the wins. Successfully managing an open enrollment is no joyride. After months of planning and implementation, you and your team deserve to celebrate. Take all of the wins from the past month, big and small, and make sure to acknowledge all of the work that went into accomplishing these goals. Now you can ride off into the sunset.

At Collective Health, we’re focused on simplifying the healthcare experience for you and your people all year long, not just during open enrollment.