Each time a benefits leader makes changes, the balancing act begins in order to meet the needs of your company as well as your people. We believe that health benefits planning can be balanced, without added complexity.

Collective Health is excited to announce the launch of the new Guide PPO, a comprehensive, value-based medical plan design that simplifies benefits and incentivizes members to make smarter decisions about their healthcare. The plan will launch on January 1st, 2021.

With Guide PPO, we’re addressing the challenge that 86% of people can’t correctly answer simple questions about basic components of their own health benefits. Much of the struggle and confusion surrounding health decisions is resolved by eliminating convoluted and highly variable plan designs. Guide PPO also helps solve the employer issue of having limited metrics to support plan design decisions—metrics that are unable to clearly evaluate and consider clinical value. Actions linked to improving health outcomes and reducing healthcare costs—like utilization of primary care—become more obvious and available.

What’s New:

The Collective Health Guide PPO is designed to help employers control costs while encouraging members to seek care associated with improved health outcomes:

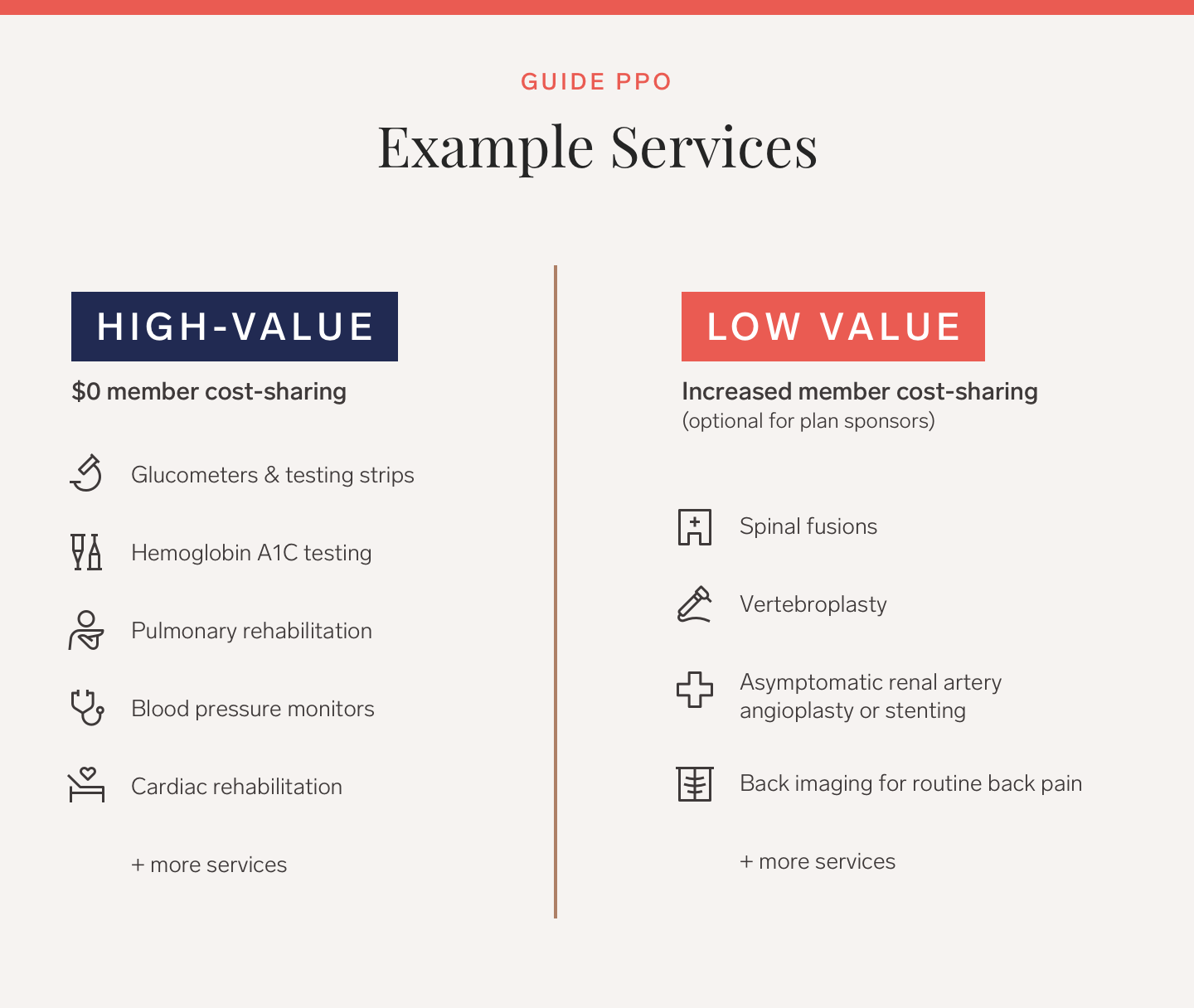

- Identification of low- and high-value services supported by recommendations from leading academic experts and doctors.

- Simplified cost-sharing puts health plan navigation into simple terms, helping members make smarter care decisions.

- Industry-leading navigation resources empower member decision-making through education, support tools, and proactive guidance along the way.

Drive value plan design with Guide PPO

Collective Health helps people get the most out of their healthcare experience by identifying services that are associated with improved health outcomes and cost sharing opportunities that can reduce usage of low-value care.

The value of health services are assessed using the Value-Based Insurance Design (V-BID) model—developed by experts at Harvard and the University of Michigan. The V-BID strategy aligns member cost-sharing for services with expected clinical value. The Guide PPO also incorporates design elements developed by Collective Health’s team of plan design experts.

Here are some supported health services and how it works:

Benefits and cost-sharing made simple

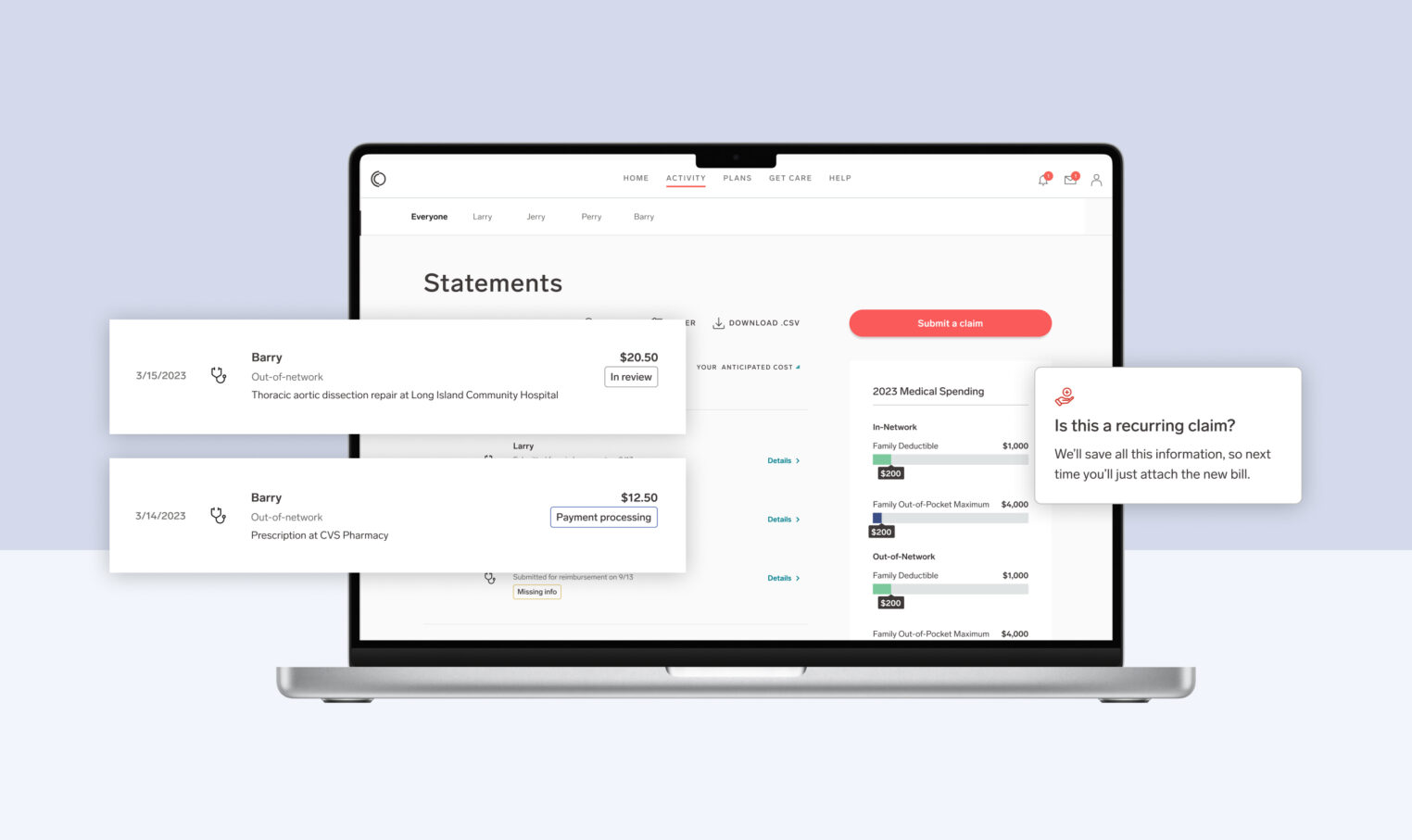

People want to clearly understand the value of the care they’re getting. Guide PPO’s simplified plan design married with Collective Health’s personalized recommendation system helps members actually understand and navigate their care options.

Health benefits should be easy to grasp. Guide PPO is a predominantly copay-based plan, as people are more comfortable comprehending copays than other cost-sharing forms.

Lower copays incentivize the member to use benefits that are more highly valued by the plan. And there’s nothing more intuitive than getting care for free. Guide PPO offers $0 member cost-sharing for services identified by the V-BID model as high in expected clinical value. Additionally, members only need to remember four co-pays for the most commonly utilized services: $10, $50, $200 and $500.

Once members understand their available benefits, they’re better equipped to act on the behaviors encouraged by the plan’s differential cost-sharing—like visiting their primary care physician before seeking specialty services, going to urgent care instead of the ER when appropriate, or taking advantage of free blood glucose monitoring for people with diabetes.

Education and navigation solutions set members up for success

Value-based plan design is most powerful when paired with high-touch member education. We engage with members in a number of ways:

- Open Enrollment – With our award winning Open Enrollment experience, we introduce the plan to members in terms they understand.

- Member App and Features – Our web and mobile tools are available to members year-round and include simple, easy to understand information on their coverage.

- Personalized Recommendations – With stronger personalized recommendations, we encourage care decisions that can lead to better health outcomes and potentially lower costs.

- Care Navigation – With Care Navigation, our team made up of nurses, social workers, pharmacists, and more—we conduct proactive, outbound outreach to members with complex or chronic care needs. For example, someone getting expensive infusions at a hospital will receive a warm outreach from one of our pharmacists to explore the cost-saving option of prescribing that infusion for at-home delivery.

Bringing value-based plan design to life

The challenge:

MRI costs can vary dramatically—by some estimates, from $300 to $3000 within the same geographic area, without a demonstrated difference in quality. From claims data, we know that for the exact same type of MRI, the allowed amount at an outpatient hospital can be up to 4x higher than at a free-standing Radiology center.

Unfortunately, members don’t usually have that information on-hand prior to receiving the service, nor do they understand how they will be impacted by it on a coinsurance-based plan.

The Guide PPO solution:

The goal of this feature is to guide members to lower cost alternatives for the same exact procedure, reducing waste and saving themselves and their employer money.

We’ve designed the Advanced Imaging benefit with two distinct copays based on the place of service.

- For Advanced Imaging performed at a freestanding Radiology center, members pay a $50 copay.

- If the member receives the same service in the outpatient hospital setting, they pay a $200 copay.

Navigation tools activate behavioral change

Collective Health uses personalized recommendations to identify the member when they get a prior authorization for advanced imaging. We proactively educate them about their options before the claim is incurred, incentivizing them to take advantage of optimal cost-sharing.

Supported by dynamic adjudication policies

Our ability to get really specific about how we adjudicate claims—in this case, flagging and treating identical claims with different sites of care differently—lets us introduce plan designs that optimize for facility, frequency and even condition-specific procedures.

With reputable data, simplified plan design, personalized member navigation, and dynamic claims adjudication, Collective Health is providing a mechanism for employers to maximize their return on investment in employee health benefits and wellness and take care of their people.

Interested in learning more about how Collective Health can help your company take control of your health spend? Fill this out and someone will be in touch.