“As a CFO, I’ve never had the financial controls in benefits that I demanded from every other part of my business. When my team found Collective Health, it was a no brainer. Their technology and concierge approach has completely transformed our investment—it’s been magic ever since.”

—Karen Boone, former President, Chief Financial, and Administration Officer of RH (formerly Restoration Hardware)

From financial planning to managing budgets and analyzing strengths, weaknesses, and opportunities, as CFO, you’re the one making decisions that impact the financial health of your organization. And with health benefits often serving as one of the biggest line items on your annual budget—and the dollar amount seemingly going nowhere but up—you’re likely looking for a way to manage that spiraling spend.

The good news? You can rein in those healthcare costs. Here are five things CFOs need to know about partnering with Collective Health on their organization’s health benefits.

- Our administration is connected—and reduces waste

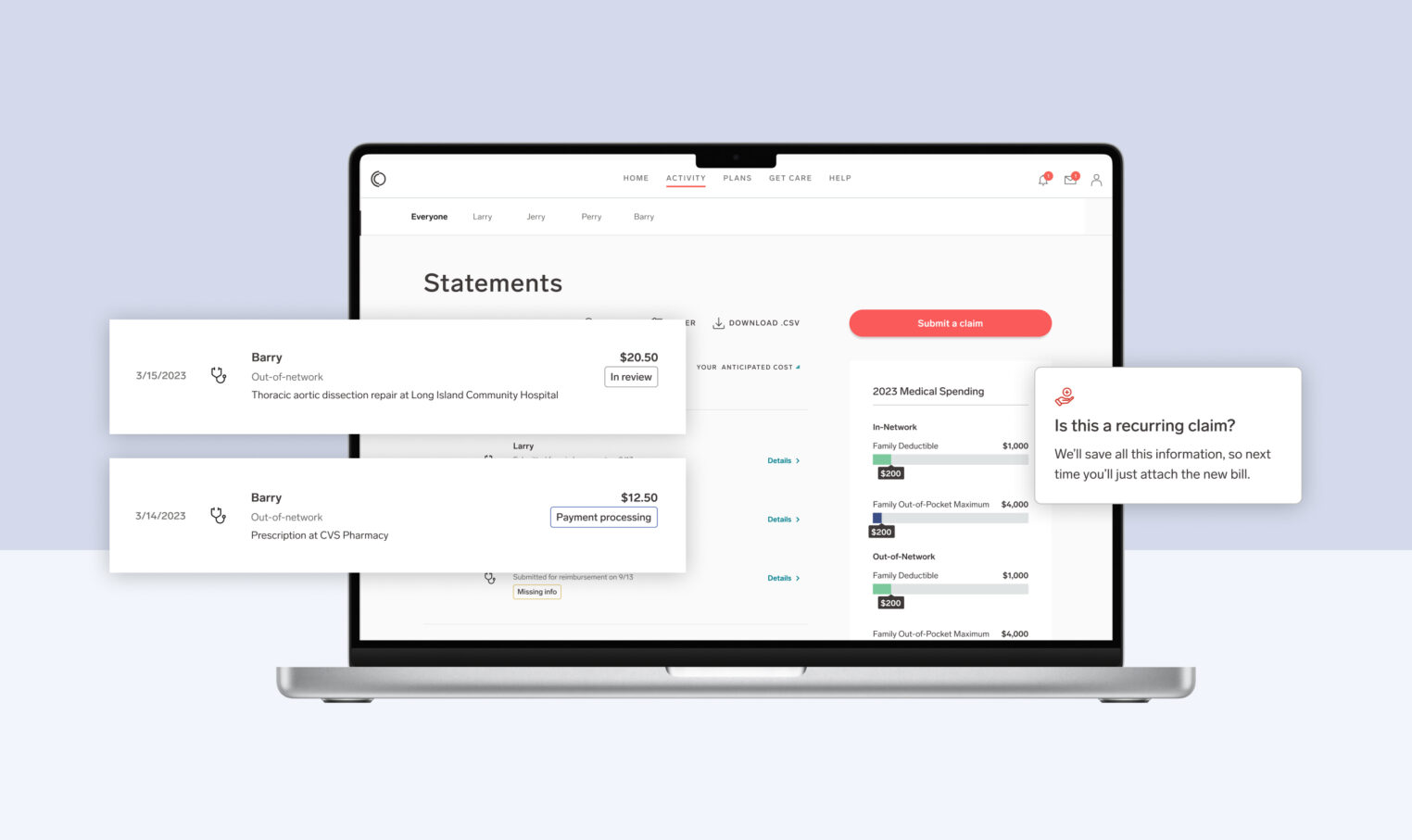

Our software administers your workforce health program and integrates with your finance and HR systems. In 2017, we found errors in 57% of invoices from a subset of partners, avoiding waste our clients may never have caught. That means you and your team have more time to focus on planning and strategy instead of combing through error reports. - Real-time insights give you power over healthcare spend

Our real-time performance intelligence means you can finally understand where your healthcare investment is going and make adjustments to optimize spend. With complete utilization, spend, and user experience data, you can see where your dollars are having a real impact, where they aren’t, and where you need to make changes. - We give you the ability to control costs

We help you manage total costs in two ways. First, through cash flow visibility—you can see where you’re spending money and why, giving you the flexibility to make adjustments as needed. And second, by helping your workforce navigate to the most appropriate resources for their care needs. With Collective Health, you can finally take control over spiraling healthcare costs. - Our easy-to-access, open ecosystem delivers an unparalleled user experience

All of your health and wellness partners are connected through our platform. Whether your employees are trying to look up a primary care provider or access your behavioral health solution, they know exactly where to go and how to do it. And an intuitive, easy-to-use experience when it comes to benefits means happier employees—and stronger talent retention. - Our members love us—just look at the numbers

Our Net Promoter Score (NPS) is 75+. Our approach builds trust with members, helping them get the right care at the right time. Collective Health members love their benefits, and it shows.

Still have questions about Collective Health? Check out our Buyer’s Guide to learn more about our packaging and pricing.