As benefits leaders, brokers, and consultants plan for next year, self-funding may become a viable option to keep your program in step with organizational growth and financial goals. For smaller companies, partially self-funded or fully-insured plans may be more suitable.

67% of covered workers were enrolled in a self-funded health plan in 2020, with the vast majority of large firms choosing some level of self-insurance. Almost 25% of small employers chose a self-funded healthcare plan as well.

Self-funded health insurance plans offer several potential benefits, including cost savings and more freedom regarding plan structure. Plus, an evolving marketplace with companies like Collective Health, an integrated solution that allows self-funded employers to administer plans, control costs, and take care of their people, makes self-funded group health plans a viable option for more businesses.

While a self-funded health plan may not be a perfect fit for every business, exploring the differences between self-insured and fully-insured health plans can help you decide which employee benefits strategy is best for your company.

Download now

Self-funded vs fully-insured overview

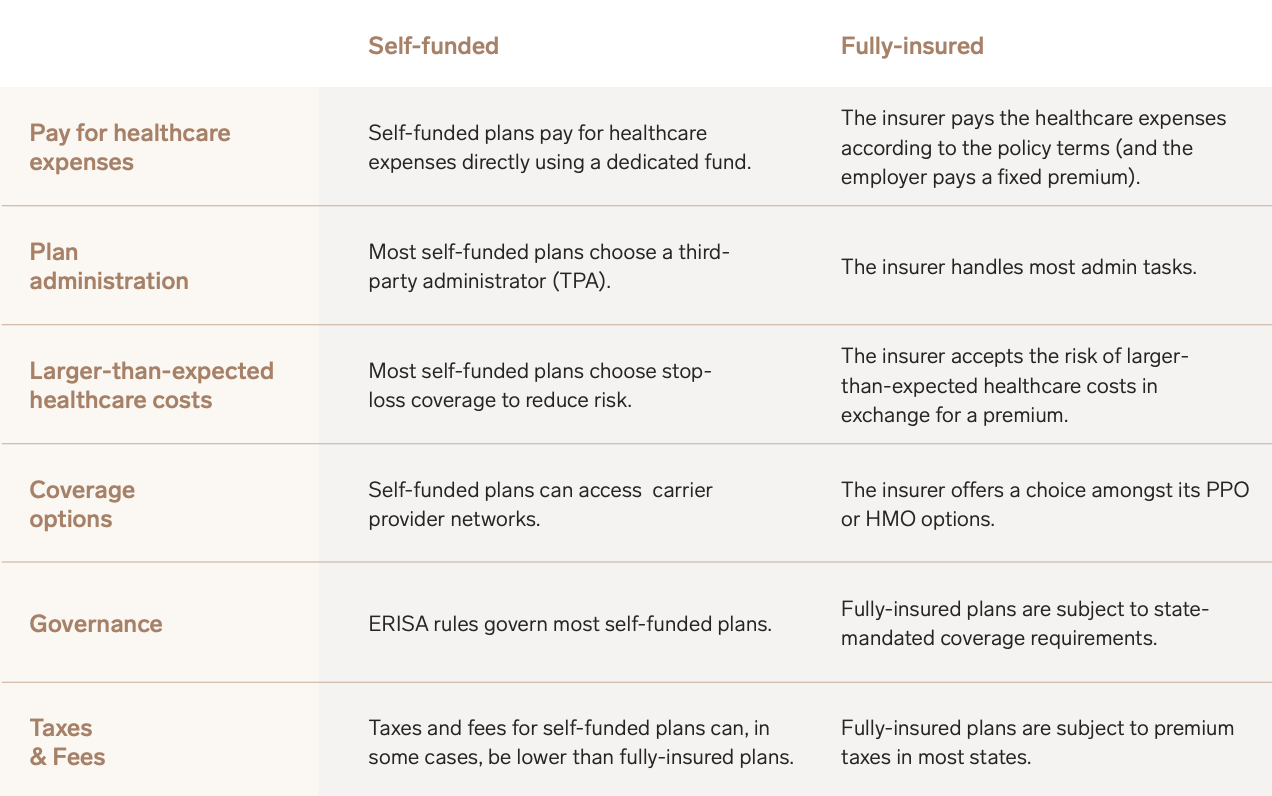

When an organization self-insures a group health plan for employees, it involves creating a fund that pays employees’ health claims as they occur by taking on the risk of personal damage to the individuals covered.

Thus, self-insured healthcare differs from fully-insured health plans, where the employer pays a premium each month to a health care insurance company. In exchange, the insurance company assumes the risk and covers all or a portion of employees’ healthcare costs, depending on the plan and pre-determined health benefits packages.

The benefits of self-funding

For the employer, the financial downside of traditional insurance coverage is three-fold. First, under the insurance policy, the employer pays the insurance carrier a fixed premium for each individual based on the assumed financial risk of an entire population pool.

And because those premiums are fixed costs, it means that even if employees don’t utilize their employee benefits, the employer has spent a significant sum on insurance premiums and doesn’t receive any surplus money back. Finally, traditional insurance plans are beholden to certain fees and mandates under the Affordable Care Act (ACA) whereas self-funded plans are exempt.

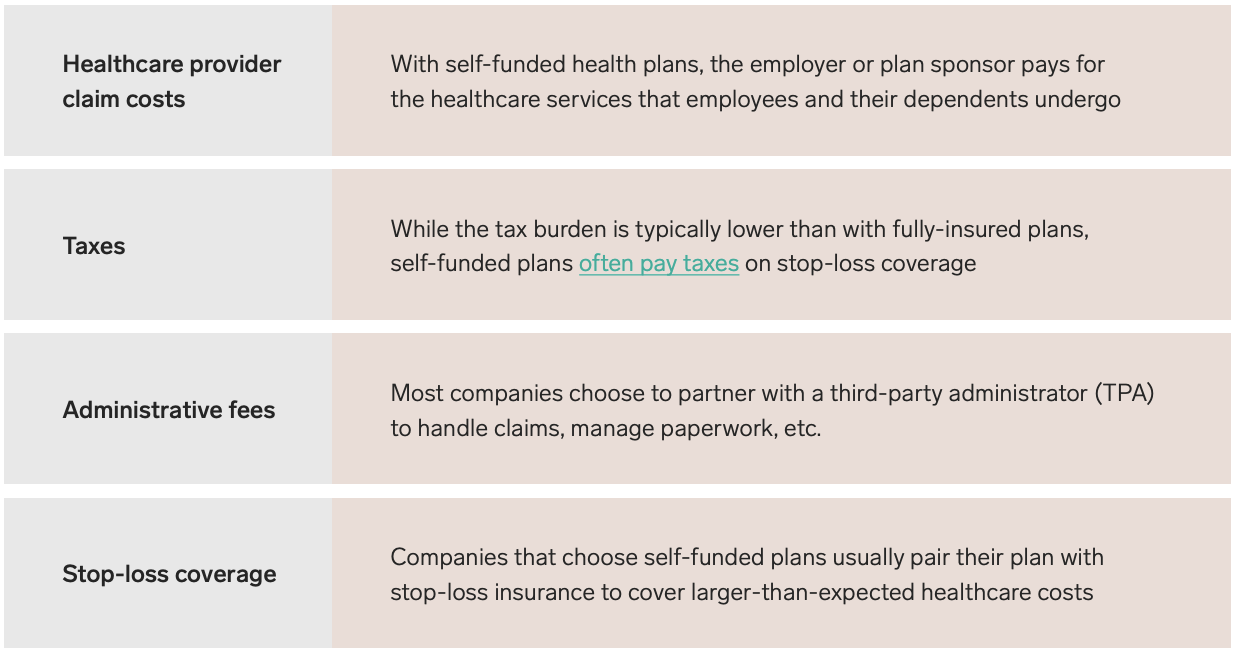

For self-insured organizations, the costs of employee health plans are fixed based on the number of employees enrolled in the benefit plan each month and the organization’s health as a whole. So the healthier the employees are, the lower plan costs will be for the employer. And instead of paying a premium tax that contributes to the insurance company’s profit margin, organizations that self-fund pay into their own pool and distribute the surplus as they see fit.

Stop loss insurance for catastrophic events

For the small employer, unexpected catastrophic expenses such as accidental injury or sudden illness could be potentially devastating and severely impact cash flow. That’s where stop-loss coverage comes in. Stop-loss insurance that can protect organizations from large claims that could potentially bankrupt the self-insured claims fund.

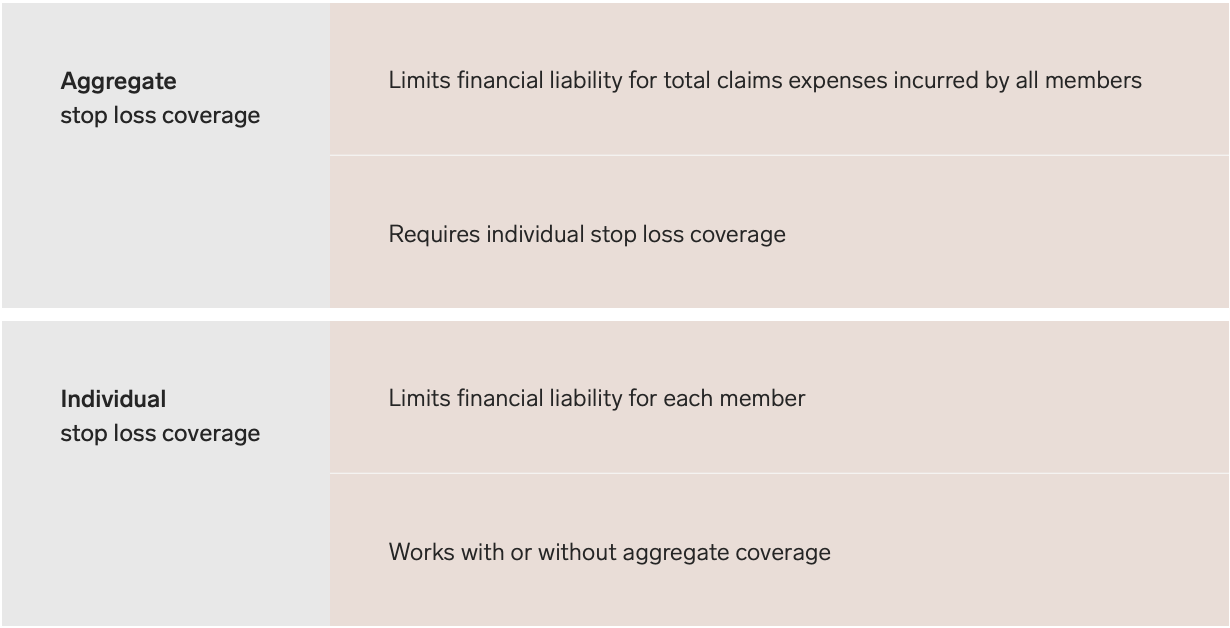

There are two types of stop-loss insurance—individual stop-loss and aggregate stop-loss—that can be beneficial for an organization self-insuring. Individual or specific stop-loss provides coverage for each individual on the self-insured plan, with set amounts above which the insurance company will cover 100% of the member’s covered claims for the year.

Aggregate stop-loss covers the total annual fees of the self-insured health plan and an upper limit for the overall plan costs. This gives the employer the security of knowing there is an upper limit in terms of overall annual cost that the plan cannot exceed.

Managing self-funded healthcare plan

There are many advantages of self-insuring, however, enlisting the help of a third-party administrator (TPA) like Collective Health for an administrative fee is beneficial for a number of reasons as well.

TPAs can support a self-insured organization with a range of administrative functions such as helping with health insurance plan design, such as determining allowances for copays, deductibles, and out-of-pocket expenses, or facilitating enrollment, identifying providers, and processing medical claims in addition to a broad range of other administrative functions.

Engage a third-party administrator (TPA)

Third party administrators can take on the administrative burden of self-insured healthcare, freeing up an organization’s finance and human resources executives to drive business. Below are some of the key services you can contract with a TPA:

- Enrollment for eligible employees

- Call center support

- Billing and payments

- Health plan design

- Member education

- Stop-loss claims

- Healthcare cost reports

If you are a consultant, broker, or organization and want to learn more about how Collective Health can benefit your clients or your business and your bottom line, please contact us today.

How Collective Health can help

Collective Health is uniquely positioned to serve as a “transition partner” for clients, helping HR teams transition from fully-insured to self-insured. With streamlined billing, invoicing and eligibility for clients, and expert help at every stage, we simplify the journey for employers by walking them through the process AND supporting them administratively.

- Financial Management & Payments (FMP): The thought of managing all of those invoices for a self-insured plan can seem daunting. With CH, we take on the administrative burden of facilitating payments to all network partners and point solutions that are integrated with the Collective Health platform, along with the associated reporting, providing clients with a set of tools to effectively manage their health benefits budget.

- Streamlined Eligibility: Collective Health takes on the processing of eligibility files. Clients send us a single source of truth, and we make sure eligibility is up-to-date for all networks and partners.

- Experienced Support Team: Our Client Success team are true partners in helping employers run their health plan. Our experienced team has backgrounds from every part of healthcare, from traditional plans and consulting to point solutions and provider systems.

- Smart platform: Collective Health has built a smart platform for rolling out a self-funded health plan that relieves HR teams of the burden of enrollment workflows and integrations.