Our Financial Management and Payments solution (FMP) streamlines administrative burdens for HR and Finance teams and increases the rigor, accuracy, and efficiency of their healthcare partner payments. Find out how in this article.

Self-funded health plans can have an array of benefits for organizations and their people, including greater flexibility in the choice of networks and partners, more opportunities for cost-saving, and more robust data reporting that can better inform your health plan design.

The need for competitive benefits is greater than ever, and self-funded plans like those offered with Collective Health, allow employers to bring on the best partners to service their members.

However, for many organizations, the thought of moving to a self-funded health plan is daunting because they don’t have the structure, headcount, or processes in place to manage all the new parts of their plan effectively. This becomes especially difficult from the financial management perspective.

Self-funding your plan can be daunting

The difference between the payment structure for a traditional and self-funded health plan is stark. When you combine the operational complexity of self-funded health plans and the highly-fragmented nature of vendor/partner ecosystems, the financial teams responsible for the payments can find themselves easily overwhelmed.

Essentially, these teams can go from making one monthly payment to their insurance carrier, to organizing and preparing as many as 20 or 25 individual payments that are due at different days of the month to various vendors and partners.

This new process is difficult for finance teams to manage and it also creates a headache for forecasting an organization’s cash flow. Not to mention, the administrative side usually spills over onto HR and benefits leaders, who are already busy trying to figure out how to attract and retain talent.

Streamline self-funded billing and payments with Collective Health

At Collective Health, we understand just how challenging it can be to manage the financial aspects of a self-funded health plan. That’s why we’ve built a comprehensive suite of financial management and payment options that are adapted to the needs of growing companies as well as those with more self-funded experience.

Collective Health has developed a robust financial management and payments solution (FMP) to ease the transition to self-funded health plans and, for those who are already self-funded, to streamline their administrative burdens. From taking over payments and providing timely financial reporting to assist in predicting the timing of payments, our goal is to make our customers’ lives easier.

Here are some of the benefits that come with partnering with Collective Health:

- Potential cost savings through identifying and preventing vendor overpayment

- Operational efficiencies gained by offloading time intensive processes to Collective Health

- Improved cash management made possible through better insight into amount and timing of payment flows

- Robust month end reporting for clients’ finance and accounting teams

- Banking fraud prevention services

- Issuing reimbursements to members for out-of-network medical claims

Collective Health’s FMP services in a nutshell

Collective Health provides a range of financial management and payment services that streamline operations for self-funded companies. Plus, clients can offload time-intensive processes to Collective Health, including:

- Payments – weekly & monthly

- Bank account maintenance & reconciliation – weekly & monthly

- Self-billing and reconciliation of headcount-based admin fees & premiums – monthly

- Invoice review – weekly & monthly

- Partner billing/payment/invoice questions – ad hoc

- Financial reporting – weekly & monthly

Ultimately, with FMP, Collective Health takes on the time-consuming, meticulous tasks of managing the myriad invoices and payments for a self-funded health plan, so that our clients can focus more on what really matters— their people and their bottom lines.

Download this free report now

Administrative tasks covered by our FMP services

From billing and payments to robust weekly reporting, our solution provides our customers with the timely, transparent support they need to optimize their self-funded health plans.

Billing and payments

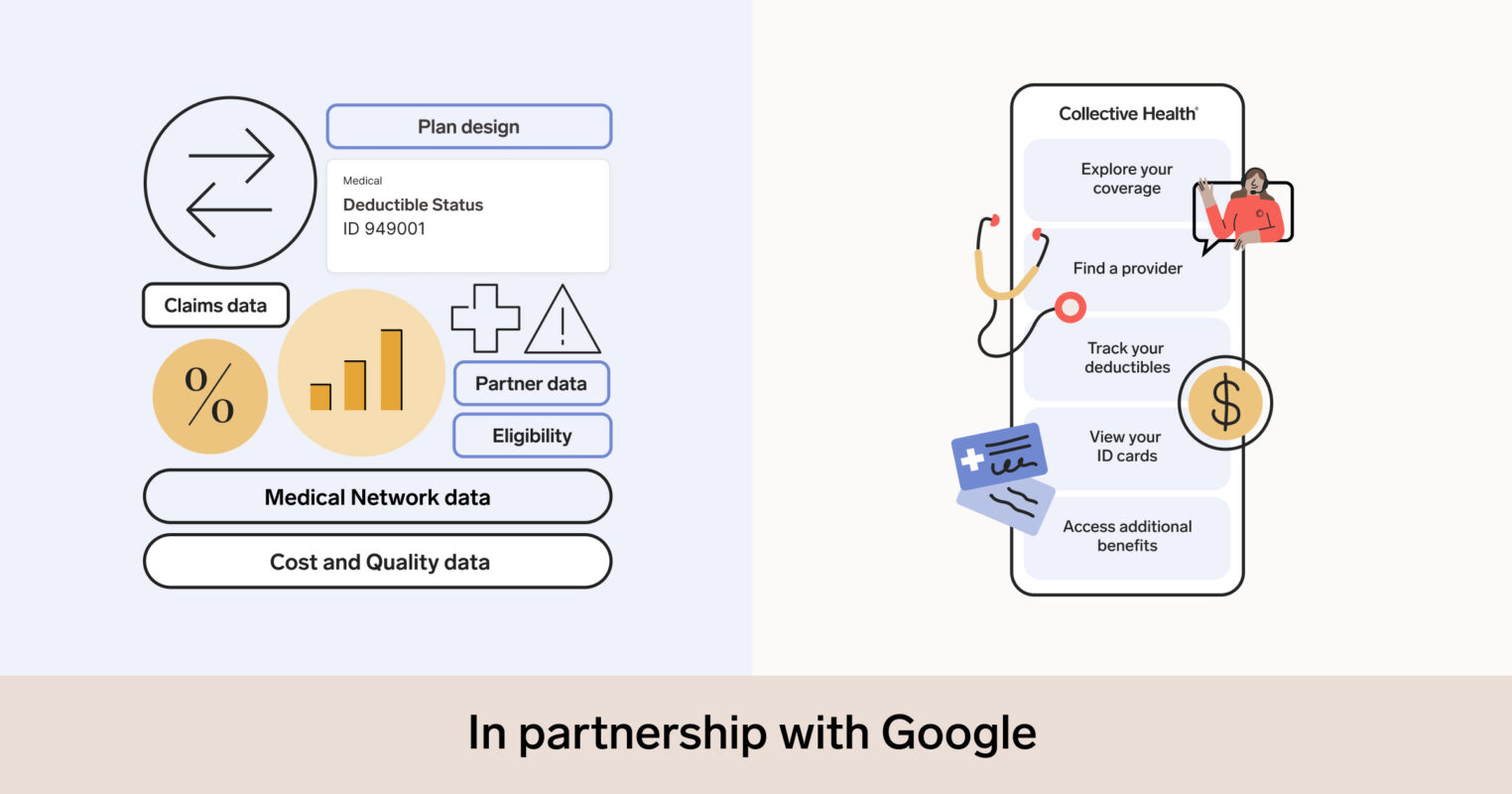

We administer health plan payments for claims, administrative fees, and premiums on behalf of our customers. During implementation, we complete our Partner Payment Matrix, which outlines the health plan partners and vendors Collective Health will pay on their behalf.

We also have the ability to self-bill our clients’ administrative fees and premiums, which means we don’t have to wait on invoices from our customers’ benefit partners. Since we also manage their eligibility, we can ensure the highest level of accuracy with our payments and make adjustments based on eligibility changes.

Financial reporting

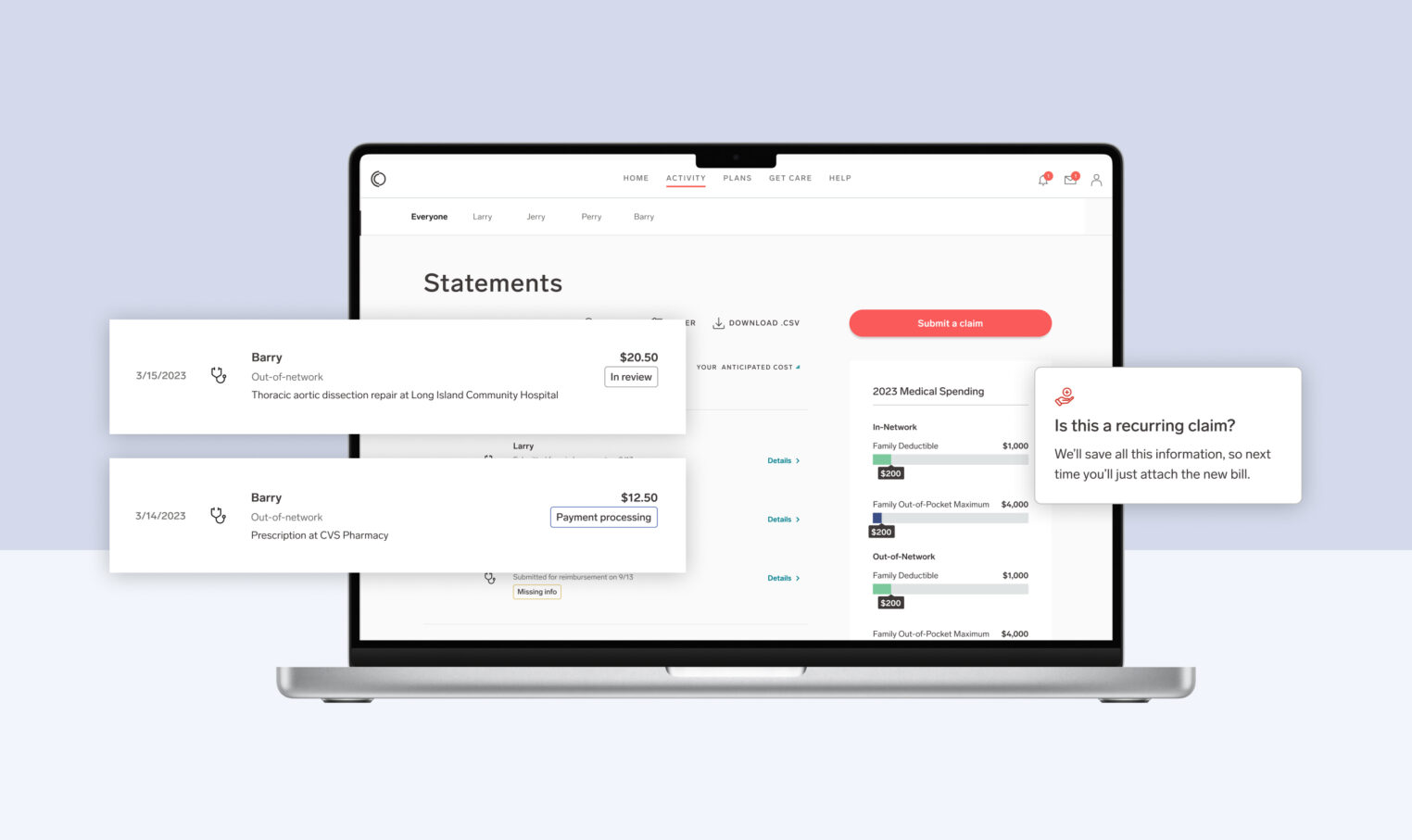

We generate weekly reports that summarize health plan expenses, which employers can easily access in their Collective Compass™ portal. This weekly report summarizes all open health plan invoices by category (e.g., claims, admin fees) and by partner/vendor, and includes supporting invoices.

We also provide a Monthly Reporting Package that summarizes all health plan expenses paid by category and partner as of month-end, as well as year-to-date. Unlike most health plans that take an industry average of ~25 days after the month’s end to deliver your data, our Monthly Reporting Package is provided after just 5 days.

Client support

Starting at implementation and continuing throughout the plan year, our team is here to answer any questions our customers and their partners have related to billing, payments, or reporting. We also can manage the initial billing integration and setup, including collecting vendor W-9s and payment information.

How FMP works with Collective Health

“One component of the shift is the billing. Having one bill for all of these partners together is super easy, and we have a weekly funding summary that tells us what we need to pay for all of our claims.”– Sheila Krueger, Head of Global Benefits at Zoom

When clients purchase FMP support, Collective Health manages all health plan payments on behalf of the customer. Collective Health provides our clients with access to a financial team who is dedicated to gathering, interpreting and summarizing partner payments and employee benefit reimbursements into one easy payment.

This is done by providing the customer a weekly summary of payments to be made on their behalf. Once approved, Collective Health then takes the lead in initiating those payments to the benefit partners, saving our customers the time and resources needed to forecast expenditures, create and process invoices, and ensure timely out-of-network payments for employee health claims.

Conclusion

Moving to a self-funded health plan may provide the opportunity for greater flexibility, cost-savings and transparency for your company, but managing all of the administrative work and payments may seem overwhelming, especially if you’re a small or mid-sized business.

When you transition to self-funded with Collective Health, our FMP solution takes care of so many of the anticipated hurdles and time-consuming tasks, and also provides you with the insights and timely reporting you need to make informed decisions about your health plan.