Background + Problems to Solve

Plan design is the backbone of any health plan offering. A well-designed health plan should set clear expectations of what actions/services the plan values (e.g., in the form of reduced cost-sharing) and what actions/services the plan seeks to discourage (e.g., in the form of higher cost-sharing). Today, plan design is an imperfect process.

Common issues raised about plan design include:

- Convoluted member out-of-pocket determination structures that create confusion for the member

- Misaligned incentives that place additional burden on members in situations where they lack control/autonomy/expertise in decision making

- Wide variation in designs–from few controls to align incentives to draconian structures that place undue financial burden on the member

These issues arise because plan designs answer the wrong questions. They look at incomplete metrics, like expected cost and actuarial value, without accounting for member health metrics and the clinical evidence for or against such a decision. The health benefits market speaks abstractly, using terms like “evidence-based” and “value-based”, without clearly answering simple questions like “value to who?” and “evidence from where?”.

All of this points to a clear market void. Employers are hungry for plan designs, derived from current clinical research, that balance short-term and long-term financial incentives, drive tangible member behavior change, and that support improved health outcomes.

A team of experts out of Harvard and the University of Michigan have proposed a Value-Based Insurance Design (V-BID) model aimed at aligning member cost-sharing with clinical value. They were leveraging the widely-accepted Health Effectiveness Data Information System (HEDIS) measures published by the National Center for Quality Assurance, and data from the ‘Choosing Wisely Initiative‘ among other sources. (1)The HEDIS measures track healthcare access, effectiveness, and risk-adjusted utilization, including appropriate utilization of recommended condition-specific preventive care and tracking of ‘low value’ services such as procedures or therapies that are no longer recommended or considered lower value/higher cost than alternatives. Paired with our internal expertise and ongoing innovation regarding member support, we believe the V-BID model offers the level of clinical rigor warranted to develop a truly evidence-based plan design.

How Collective Health helps employers address the problem

Across our forward-thinking employer and broker/consultant partner base, we’ve recognized a common desire to implement plans derived from the latest clinical research, that balance short-term and long-term financial incentives, drive tangible member behavior change, and that support improved health outcomes. In response, Collective Health has developed the Guide PPO, a comprehensive medical plan design option for employers that is rooted in clinical evidence, and which we believe can incentivize members to make better informed decisions about their healthcare.

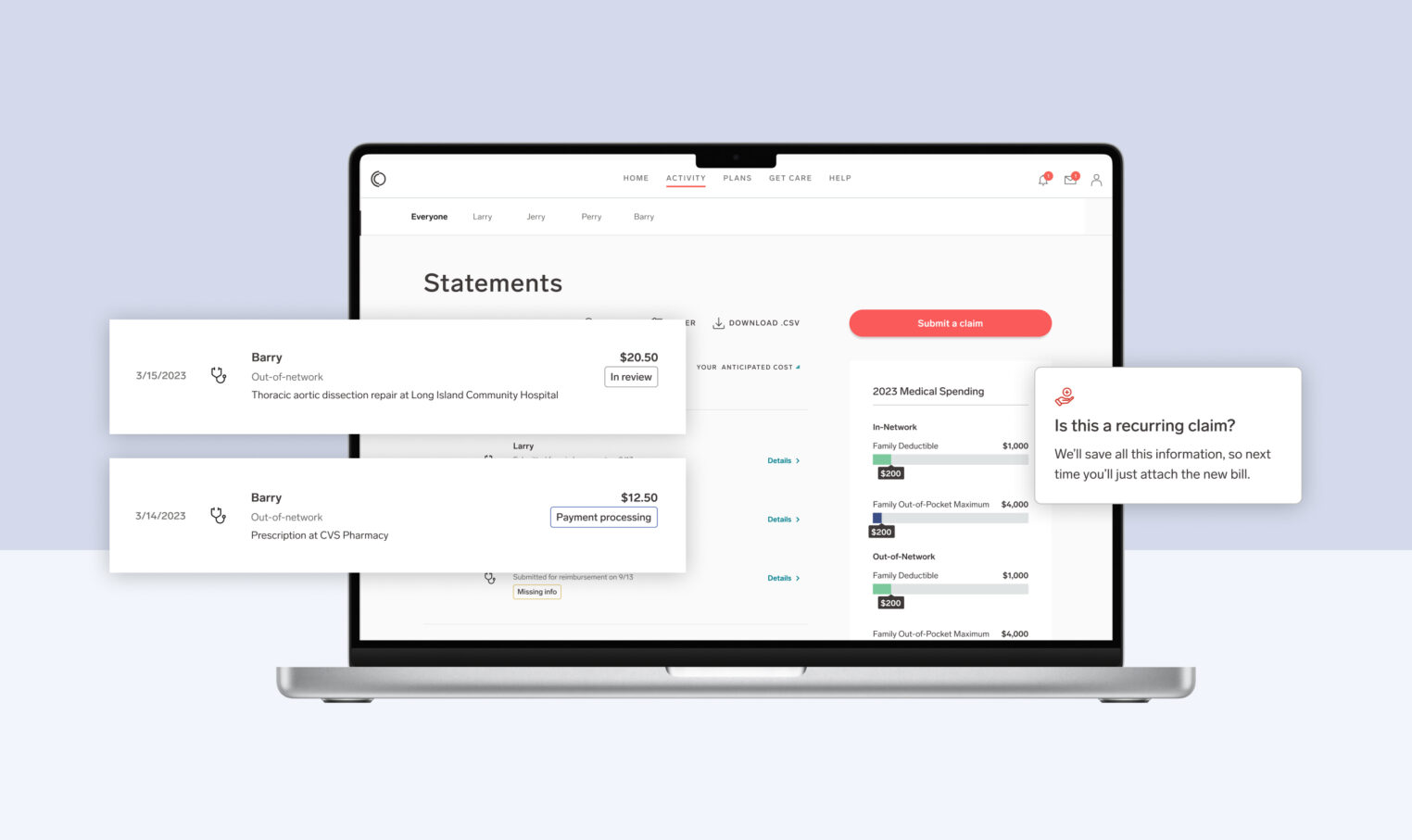

Core to the thesis that the Guide PPO can inspire meaningful, beneficial behavior change is our ability to support ongoing member education with personalized recommendations. We intentionally built member outreach efforts into the plan design to engage and inform members they receive certain services. This differentiates our evidence-based plan design option from others, in that it doesn’t operate as a blunt force instrument, relying on members to proactively educate themselves about plan design. The following is an example of evidence-based plan design combined with Collective Health’s holistic member support.

Advanced Imaging

Plan Design: For the exact same type of MRI, the allowed amount at an Outpatient Hospital can be up to 4x higher than at a free-standing Radiology center. Unfortunately, members don’t often have that information prior to receiving the service, nor do they understand how they will be impacted by their choices on a coinsurance-based plan. (2)

There are two distinct copays based on where the advanced imaging services are provided:

- $50 at a freestanding Radiology center

- $500 at an Outpatient Hospital

Hypothesis: By proactively educating members about their Advanced Imaging benefits and provider options before they incur higher copays, Collective Health can raise member awareness of lower cost alternatives available under their medical plan—a potential benefit to both the member and the plan.

Some findings during the first 2 quarters of 2021:

- With a combination of digital and human outreach, members scheduled at an outpatient hospital imaging center for advanced imaging tests chose to switch to a lower-cost free-standing center in 55% of the cases.

- We received overwhelmingly positive feedback from members on our proactive outreach to educate them on lower cost free standing imaging options under their plan benefit.

- More advanced imaging tests were performed at free-standing centers (65% vs 35%) than in the outpatient hospital setting.

- An average of $1,200 in plan sponsor savings was realized when a member switched their scheduled test to a free standing radiology center.

Other early findings (as compared to other PPO plans offered by plan sponsor for the first 2 quarters of 2021) suggest:

- 66% higher preventive care utilization

- Higher Net Promoter Score (NPS) and Customer Satisfaction (CSAT) scores

- Lower total spend on a per member per month (-$7 PMPM) basis after risk-adjustment.

We will need more time to see if such results carry through at greater scale, but initial findings are promising.

Conclusion

Based on limited data, our early findings suggest that an evidence-based plan design, such as Guide PPO, can reduce costs while increasing use of preventive care services, which can help prevent long-term health issues. A simplified plan design centered around clinical evidence with member cost share that is lower for high-value services can be an attractive alternative to traditional PPO offerings.

References:

- v-bid x: creating a value-based insurance design plan for the exchange market. chernew m, fendrick a, buxbaum j, et al. health care markets & regulations lab department of health care policy harvard medical school. june 2019.

- Consumers’ misunderstanding of health insurance. Lowenstein G, Friedman JY, McGill B, et al. J Health Econ. 2013 Sep;32(5):850-62.